Want to apply for a car insurance cover? With Ohio-based Root Insurance, you can be assured that premium will be fixed objectively – based on the applicant’s driving skills, evaluated during the mandatory 3-4 week test drive period. Using an AI-powered mobile app that leverages the phone’s inbuilt sensors, Root Insurance assesses on-road risk factors such as tailgating, fast turns and texting. This helps screen out the bad drivers, and in turn, identify and reward good drivers with lower rates. With this new-age pricing model, the startup claims that eligible customers can end up saving up to 52% on the premium.

In November 2018, the Root Insurance app was upgraded to record time and frequency of smartphone use when driving by harnessing the phone’s gyroscope and accelerometer. Thanks to the inclusion of these additional variables into the algorithm, reportedly, applicants who avoid using their mobile devices while driving can save an additional 10% on their insurance quote.

This usage-based insurance (UBI) policy provider claims that it mandatorily collects the data only for a limited period of time, mostly before issuing the quote.

“It usually takes about three weeks to gather enough data for a quote. After a user purchases, we’ll usually monitor them for about ninety days,” Root Insurance co-founder Alex Timm explained to Crunchbase. “But after they purchase a policy, consumers can always turn off the data collection.”

The mobile-only car insurance company also insists that data privacy crusaders needn’t worry as it collects data only for its own risk analysis – to help customers get the discounts they rightly deserve.

“We’ve never sold data and never will,” said Timm to New York Times. They claim that their priority is to protect user data.

Benefits of Usage-Based Insurance

On the back of its self-proclaimed “relentless pursuit of fairness”, Root Insurance is able to offer premiums that more closely matches its cost of providing individual policies. This is something most UBIs do. Thus, by increasing pricing accuracy, they are able to retain and attract good drivers who now get better rates.

As reported in TechCrunch, Timm said, “For the best 30% of drivers we cut the price [of insurance] in half. For the best 70% of drivers, we’re the cheapest in the market.”

Also, it upholds the ethical tenant of victory of good driving over bad driver, by penalizing the latter and rewarding the former.

The company turns away 30% of those who download the app, a spokesperson said to Mansfield New Journal.

“If we think you’re a bit too risky of a driver for us, we actually don’t offer a quote at all. We just tell them they’re going to get a better rate from a traditional insurance carriers,” he added to Mansfield Journal.

In the long run, this helps make the roads a safer place for all.

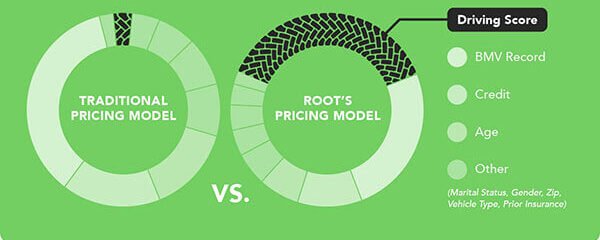

UBI also helps consumers by reducing dependency on demographics, since demographic data and credit rating is no longer considered a very inclusive way to determine rates. With the growing accuracy of telematics risk scores, even a 16-year-old (who might just be a safe driver) who participates in UBI stands a chance of escaping an unfairly steep premium price tag assigned just because of his incriminating age.

“All of this sensor data started to fly in, and one of the things that was pretty obvious was all this data was more important in predicting than a good risk or a bad risk, and certainly a lot more important than something like credit score,” Timm told VentureBeat.

Pricing Model of the Future

But before the very concept of UBI was even developed, over a decade ago, Timm’s journey started in the insurance industry working for his father at Century Insurance.

As reported by Dispatch, initially, his father was against him joining the firm. He told Timm that he would have to pass an impossible math test, that was well beyond his years if he really wanted the job.

“He didn’t want to give me a job,” Timm said “I took the math test and aced it and said, ‘Now you have to give me a job.’”

Once he completed his studies in actuarial science at Drake University in Iowa, he joined Nationwide Insurance. That is where the seed of the UBI concept was sown in his mind. He reportedly spent a lot of time and effort trying to get Nationwide to build a better product, based on AI but realized that getting an incumbent to modernize its core value proposition was next to impossible.

Around that time, a few traditional insurance companies had begun offering a tracking device for customers to install in their car to check if they qualify for a discount. But this seemed much much less convenient than just using a cellphone app.

Therefore, in 2015, Root Insurance was borne out of Timm’s frustration that “traditional insurance providers weren’t moving quickly enough to create better pricing models using mobile data”.

The vision behind Root was to churn out individualized rates, based on driving behavior, and cut out the filling of long tedious insurance form by using smartphone technology and data science. All users have do is download the app and scan their drivers’ license for Root’s software to automatically update the insurance application with the required personal information within seconds. Then users are required to take a compulsory “test drive” to receive a results-based quote. If the user passes the test, the app also allows to customize and purchase the policy, file a claim, and cancel the old insurance policy.

But it had to be said that when they started off, the first year of operations was fairly experimental and rudimentary.

“In the very early days of Root, we were basically taking college kids and giving them dozens of cell phones and having them tape them all over their bodies and drive around,” Timm recounted to Crunchbase. Since then, the company’s data collection has advanced, with the program now distinguishing between drivers and passengers and tracking distracted driving.

That year, Timm got local venture-capital company Drive Capital to invest $7M and secured a debt facility for Silicon Valley Bank. This helped Timm and seasoned entrepreneur Dan Manges take Root Insurance off the ground.

Then they got down to focusing on clearing a laborious application process for the right to issue insurance in Ohio, which it eventually achieved in June 2016. And in October 2016, it officially launched its services in the state. Subsequently, in a series B round it raised $21.5M (June 2017), followed by $51M in a Series C round (March 2018).

Meanwhile, in March 2017, Root Insurance, initiated a new program that gives Tesla owners a discount for the increased safety of self-driving cars.

Future Forward Insurance

By this time, Root had grown explosively, with gross premiums written having tripled since fourth-quarter of 2018. This feat, having been accomplished without having invested too much in ad spends, caused a growth in positive industry perception about the brand, according to Matteo Carbone, director of the IOT Insurance Observatory and co-founder of Archimede Spac.

“We went from writing just shy of $4 million of direct premium in all of 2017, to nearly $23 million in the first half of 2018,” said Timm to VentureBeat.

By September 2018, it had grown beyond its home market of Ohio into 20 other states and showcased more than 4500% year-over-year increase in direct written premiums in the first six months of 2018.

In the same month, it secured a $100M in Series D funding to attain a $1Bn valuation. The company backed by reinsurance bigwigs such as Munich Re, Maiden Re, and Odyssey Re plans to expand nationwide by the end of 2019.

To expand its reach, Root Insurance is likely vulnerable to regulatory challenges as not all states are open to allowing insurance companies to underwrite policies based on an individual’s driving habits.

“We plan to build the biggest and best insurance company based on modern technology we can. A lot of industries have been disrupted by technology. Insurance hasn’t yet,” he announced in conversation with Dispatch. “That’s going to be us. That’s going to be Root.”

Towards this goal, within the next 3 years, it plans to add 463 employees to its payroll.

Disrupting the Auto Insurance Industry

Apart from the efforts by Root Insurance, many other UBI startups are also looking to make waves in the $250Bn U.S. auto insurance industry. In fact, based on IHS estimates, there were more than 5 million UBI policyholders in 2015 in the U.S. – highest count globally.

Progressive Insurance is the closest competitor to Root Insurance that offers discounts based on their driving through its “Snapshot” program. Unlike Root Insurance, Progressive encourages drivers to keep the app running continuously ( and not just the pre-quote period) to track the individual’s driving and offer rewards for safe driving.

While Root Insurance customers save an average of $1187 per year on car insurance policies (as compared to traditional providers); with Progressive’s Snapshot program they save an average $130 per year.

Then there are other companies that price coverage based on how much you drive, such as MetroMile ( save an average of $611 per year) and Allstate.

With so many new players in the market, Timm believes that the industry is ripe for change.

And eventually, he wants to achieve the what Amazon has done to retail – making buying of auto insurance simpler and more convenient backed by data.

Subscribe to our newsletter