While the world is full of risks, assessing risk continues to be a major challenge. Sigma Ratings, an MIT-backed non-credit rating agency, is on a quest to redefine the way the world sees risk by standardizing and quantifying non-credit risks. Earlier this month, Sigma Ratings closed a $2.4 million seed funding round led by FinTech Collective with participation from investors such as Barclays and TechStars among others.

Co-founders Gabrielle Haddad and Stuart Jones, Jr.

Sigma Ratings

Sigma Ratings was founded in 2016 by Gabrielle Haddad and Stuart Jones, Jr. Both of them have incredible backgrounds. Stuart is a former U.S. Treasury official who has worked extensively in the middle east as a Financial Attaché. During his tenure at the department, he won numerous awards for his service. After serving in the department, Stuart moved to Ernst & Young and focused on forensics.

Gabrielle Haddad testifying at Congress

Gabrielle has extensive experience as an M&A corporate governance attorney working for funds as well as law firms. Her expertise is well recognized. She was recently invited to testify before the House Subcommittee on Financial Institutions and Consumer Credit, on the implications of de-risking.

The two co-founders met at MIT while pursuing their MBA in Innovation and Global Leadership. Given their backgrounds, both of them understood that there wasn’t a good way to understand counterparty risk in many transactions. There was a need to be able to do this in a way that is standardized and quantifiable.

The team took a conscious decision to initially focus on a standardized sector such as the financial sector before moving onto other areas such as cryptocurrency exchanges and other entities.

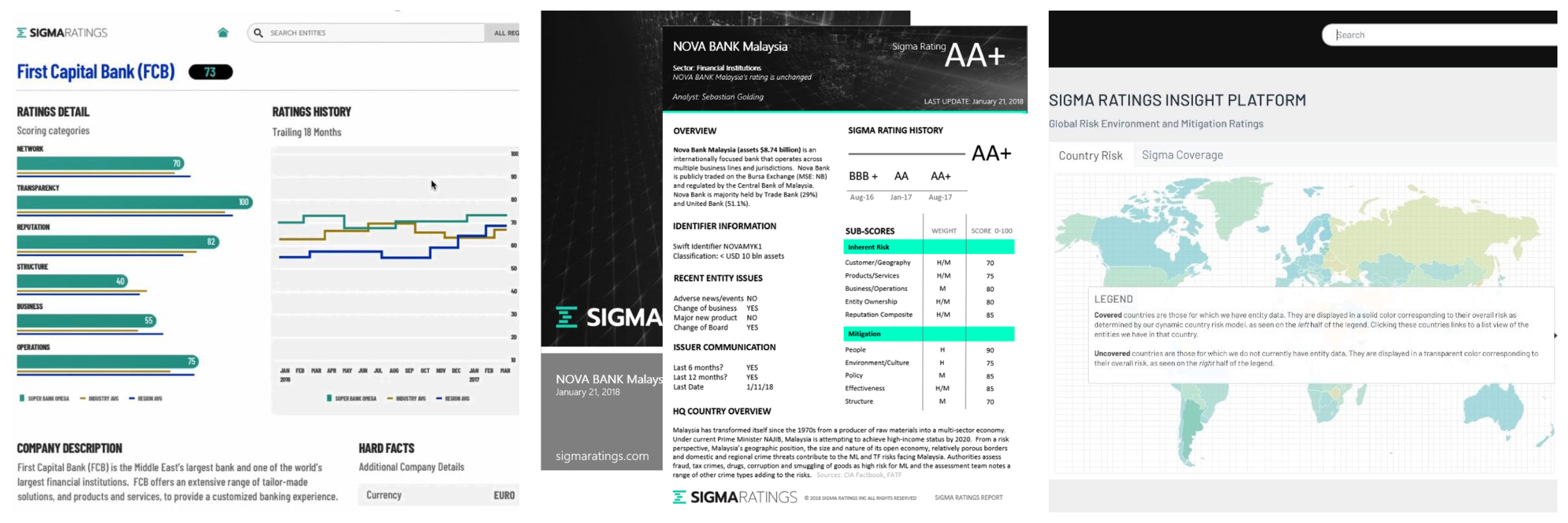

Products – Ratings and Insights

Ratings and Insights

Sigma Ratings is focused on non-credit risks such as governance and compliance as opposed to the Big 3 ratings agencies that focus on credit risk and understanding solvency issues. The aim is to quantify risks surrounding management, governance, controls and financial crime with a focus on emerging and frontier markets.

Sigma Ratings has two products – Ratings and Insight. Ratings is a dynamic business integrity risk score generated for a particular institution. It allows institutions to demonstrate transparency on non-credit risks and differentiate itself. Insight is a platform-based enterprise solution that assigns risk approximations to thousands of companies. It can be used to monitor risks in existing and potential relationships, while helping investment firms take decisions on opportunities in markets where information isn’t easily available.

Using AI and other tools, Sigma Ratings is building proprietary (patent pending) models that help analyse data that is available in the public domain about companies and churn out a risk score. Operationally, there are two dimensions to it – inherent risks and control effectiveness. Parameters such as geographical risk, products and services, ownership, reputation, management and transparency are covered while looking at inherent risks. On the control effectiveness side, they look at the robustness of the controls, experience of the team, training and technology among other things. Putting these two components together, a score is arrived at. Initially, a numeric score between 0 and 100 is generated. This is then converted into a rating ranging from C (lowest) to AAA (highest), much like the credit rating agencies.

Sigma Ratings also allows companies to opt in and share data on internal controls and processes in order to arrive at more accurate scores. Information in the public domain on controls is limited as a lot this information isn’t made public.

They had a limited beta launch of the Insights platform recently with information on numerous banks from multiple regions. At different points in time, various team members have shared some interesting findings. While China has some of the largest banks in the world, they are also the least transparent. Middle Eastern bank are more transparent and better prepared than banks in Latin America. Their polls on the Middle East show the difference between perception and reality.

Team Sigma Ratings

The Sigma Impact

Their products have received a lot of interest from non-banking entities such hedge funds and PE funds that are looking to use these ratings to aid investment decisions. Sigma Ratings could be used as an alternative data solution for firms in emerging and frontier markets.

When a country gets marked as high risk, companies tend to avoid doing business with entities from the country. This leads to a lot of missed opportunities. While there are dynamics at the macro level, there are banks and companies that have strong governance structures and management that make them strong companies to do business with. Sigma Ratings helps identify such opportunities, enabling companies to do business in markets which are otherwise sidestepped.

These scores also help companies differentiate themselves in the eyes of external investors and participants. FIMBank plc, a Malta-based bank, was the first bank to be rated by Sigma Ratings. This is the only bank in the country that has a rating. People doing business with the bank would be more comfortable given the fact that an independent third party has audited the bank’s financial crime vulnerability.

Sigma Ratings’ products can help global financial and non-financial firms, and governments effectively manage counterparty and regulatory risks. Earlier this year, the US Treasury’s Financial Crimes Enforcement Network (FinCEN) issued a notice accusing ABLV, the third largest bank in Latvia, of money laundering and violating sanctions placed on North Korean entities. This subsequently led to the collapse of the bank, triggering a confidence crisis in the country. Such instances can be safe guarded against with the right tools in place. Boards and banks can also use the ratings to understand the governance and compliance risk from an outside perspective. These insights could be used to improve controls to meet international standards as well as improve reporting.

Sigma Ratings Co-Founder with John Rodriguez from Barclays

As Sigma Ratings is solely focused on ratings, its revenue comes from the ratings given to specific entities. Sigma Ratings doesn’t provide any advisory or consultancy services in order to avoid potential conflicts of interest.

While most of the reg tech companies are focused on solutions to ease the compliance process, Sigma Ratings is unique in the fact that they are a step ahead and have focused on ratings. There is a huge information gap in the market and Sigma Ratings is working on bridging that gap.

Subscribe to our newsletter