The ad tech space has been rapidly growing while improving the US $557.99 billion (2018, statista) global ad industry. One company is taking the industry to a whole new level. NYIAX, a NASDAQ powered start-up, is the world’s first advertising contract exchange. It facilitates buying, selling and re-trading of ad contracts. NYIAX recently raised another $5.6 million in their latest seed funding round led by WestPark Capital.

NYIAX Cofounder Carolina Abenante at Global Blockchain Summit 2018 (source: Global Blockchain Summit)

NYIAX NASDAQ

NYIAX was founded in 2016 by Carolina Abenante, who now serves as CSO, General Counsel and Executive Vice Chairperson, and Mark Grinbaum, who now serves as EVP, Product and Platform. Their tie up with NASDAQ is an interesting story. While they were looking for funding in 2015, they were discussing their product with Thomas O’Neill. Thomas, who was previously on the board of NASDAQ, saw a lot of similarity between the idea being pitched and financial trading. The team met with Adena Friedman (now the CEO of NASDAQ), who loved their idea and saw an opportunity to take NASDAQ’s technology into the ad tech world.

NYIAX leveraged NASDAQ’s Financial Framework Architecture to build their platform. The team started developing the product early in 2016 and started testing mid-2017. The seasoned NASDAQ platform helped NYIAX avoid the initial teething problems new start-ups generally face.

The founders, were quick to create a strong leadership and advisory team comprised of adtech and fintech pioneers, including: Richard Bush (President), Sergey Tsoy (CTO) and board members, Bill Wise, Thomas F. O’Neill and Robert Ainbinder .

Richard Bush, President, NYIAX at Scale

The NYIAX Platform

NYIAX is a platform that enables advertisers, publishers and agencies to buy, sell, and re-trade premium advertising contracts in a forward/futures methodology. Participants can enter into contracts for slots in the future. Publishers, who are the sellers on the platform, can upload their inventory on to the platform with details and description of the inventory. Advertisers, who are the buyers on the platform, can then interact with the sellers based on their budget and other constraints. The initial focus is on the digital ad space.

For example, a publisher wants to sell a slot on their homepage for Thanksgiving this November. The publisher can do so using the platform. This is different from the real-time advertising models based real time bidding for slots.

Apart from NASDAQ’s Financial Frame Work, NYIAX uses Blockchain, Cloud and Smart contracts to power their platform. Blockchain is used as the core ledger to help with asset purchase, delivery, reconciliation and accounting. Smart contracts enable contracting on the platform.

NYIAX had a soft release last year that attracted a lot of interest. As they were building on a model built for financial concepts, it was important to translate this into media and ad concepts. They improved their systems by incorporating the invaluable feedback they got from clients during their pilot.

NYIAX Impact

NYIAX is helping automate a manual process in the ad space. Arriving at such transactions would typically involve a lot of back and forth communication via email and phones. It is a labour-intensive and time-consuming process. It involves uncertainty around price and the authenticity of the impressions and target audience. These are problems that emerge from the traditional model and the programmatic model of real time bidding.

Having such a marketplace helps publishers forecast and guarantee their revenues as once a sale is made, the delivery will take place. This gives publishers stability to their revenue projections. On the other hand, buyers or advertisers are able to get their desired spots early on. They are able to ensure that their campaigns reach the desired target audience. The publisher’s inventory accurately describes the target audience and the impressions they generate. Since the participants are vetted before being onboarded, there is an element of authenticity and trust in the system. NYIAX ensures that the sellers on the platform are selling their own inventory and not aggregating or selling a third party’s inventory.

The ability to re-trade contracts in a secondary market is a powerful tool that is made available to the advertising industry for the first time. Various dynamic pressures such as budget constraints or changes in strategy would require the advertiser to review their position on contracts. If for some reason the buyer wants to opt out, the buyer can re-trade the asset. As the terms of the asset remain same, the seller or the publisher is unaffected.

NYIAX Cofounder Carolina Abenante and Rebel AI founder and CEO Manny Puentes at Global Blockchain Summit 2018 (Image by Lana McGilvray via Twitter)

What this system does is bring transparency and efficiency. The sellers accurately describe their inventory while the buyers know exactly what asset they are purchasing. This information problem is a big challenge in deals that take place in a real time bidding environment.

As the process is automated and the advertisers are working directly with the publishers, both parties are able to reduce their cost while ensuring their goals are achieved. Association of National Advertisers found that 48 cents on the dollar are spent on supply chain data and transaction fees. For a one stop solution, NYIAX charges a fee per transaction.

Given the magnitude of publishers on the platform, advertisers reduce search cost significantly as they get access to a wide range of publishers who specify inventory, impressions, and target audiences. Publishers benefit from a price discovery process given the large number of advertisers on the platform.

The Future

Advertising is only one of the many possible use cases for the product NYIAX has developed. In December last year, NYIAX and NASDAQ filed for a joint patent for a new method of trading physical and digital assets across industries. This enables contracts to be customized and traded on the exchange. This could be done to commodities where real trade customized to the requirements can take place rather than just price discovery and cash settlement.

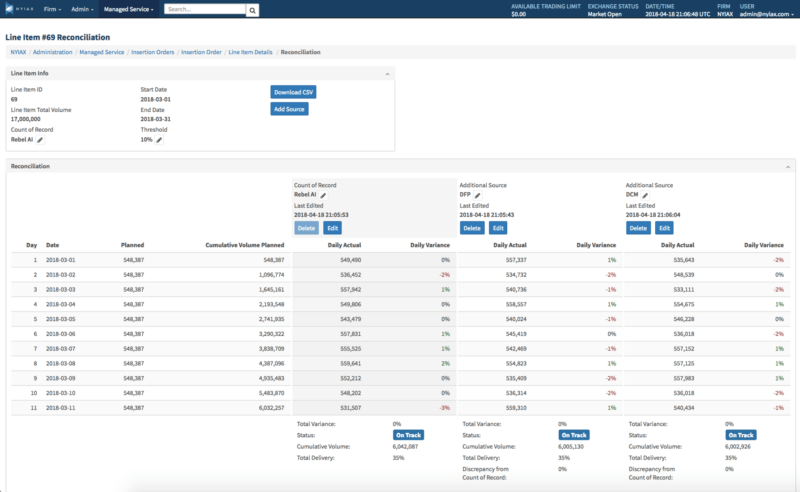

NYIAX Rebel Reconciliation (Source: MarTech Today)

NYIAX has partnered with mesmr, a blockchain-based content start-up, to facilitate monetization on the mesmr platform. With this, NYIAX is implementing its solution outside its exchange for the first time. NYIAX has also partnered with Rebel AI to help verify delivery of assets traded on their platform. NYIAX is strengthening its product while also expanding rapidly into other areas. This is a start-up that has the potential to disrupt many industries. Watch out for NYIAX!

Update: The article was updated based on inputs and feedback. Modifications were made in the ‘NYIAX NASDAQ’ section.

Subscribe to our newsletter