In October 2018, e-textbook startup RedShelf raised $25M in a Series C funding round, bringing the total capital raised to $33M+. The startup plans to use this money to improve its digital product and software, customer service, and relationship with the existing network of publishers. Also, RedShelf announced that it has been experiencing significant user growth, having doubled year on year since 2012. By March 2018, it even hit the milestone 1 million mark, which is expected to rise significantly in 2019.

But before startups like this Chicago-based firm attracted such investor and user interest, the industry was dominated by print. This was causing knowledge to be too expensive for high-school students.

In with the e-books and out with paper

On average, textbooks and supplies for college students exceed $1,000 per year. While the ‘new book’ smell and ‘dog-eared’ pages can be nostalgia-invoking, they are slowly being relegated into the past thanks to pdfs and e-readers. This shift is sure to be gradual, especially as 92% of students in the US are still reading printed books according to a survey conducted by American University’s linguistics professor Naomi Baron. With edtech startups such as RedShelf, one thing that students will definitely not miss is the steep prices of higher-ed study material and books. By offering such student’s e-content for rent, 80% cheaper than the physical copies, RedShelf marks the advent of the paperless education era.

“There is no way that 10 years from now backpacks will be filled with paper textbooks,” said RedShelf CEO & co-founder Greg Fenton to builtinchicago. “Students expect great software in education just like they do with social media, online shopping, or game applications. Ultimately, this gives students more convenient options when purchasing learning materials.”

Much has changed since its debut (in June 2010) as just an e-textbook distributor.

According to a report in Crain’s Chicago Business, the 27-year-old founders Tim Haitaian and Fenton started off with software that helped copy shops (that prepare course packets for professors) convert teaching materials into PDFs. Today, while they still deal in course materials, their focus has shifted to online books, and the startup plays a much bigger role in shaking up the college learning ecosystem.

Both founders who were raised in Detroit, believe that students and professors needed greater digitalization in the learning environment. So they created a business model wherein they textbook digital copies are rented out, at a much cheaper rate than hard-copies. This seeks to slowly but steadily eliminate the used-book (resale) market, which currently chips away at publisher’s revenue.

“All publishers wanted to talk about was, ‘how do we get rid of used books and go digital?’ ” said Fenton at a bookfair. “I think it’s a snowball effect.”

Though book publishers would face a 60% drop in revenue per book sold, it would also mean getting the target group more habituated to using ebooks. This would in turn cause students, in the coming years, to buy from the publisher again instead of going to the resale market. The students also benefit as they always get the most recent edition of textbooks and study material at a fraction of the hard copy’s cost. What’s more, these ebooks are super-portable and environment-friendly.

That which makes these ebooks affordable are the tie-ups that RedShelf has with academic publishers and campus bookstores to digitize and disseminate their books to students. Owing to such partnerships, the edtech firm has become a one-stop-shop to gain access to academic content such as e-textbooks and even research papers. In fact, RedShelf has, so far, inked partnerships with the likes of Pearson, McGraw-Hill, Cengage, Macmillan and John Wiley & Sons.

Since 2012, RedShelf has struck deals with several colleges, educators, campus bookstores and publishers to offer improved means of learning in higher ed by streamlining the ‘selection, adoption, purchase, and distribution of digital course materials’.

Then in 2018, publishers further dropped prices to gain greater market share. This is why the average textbook at Redshelf is now priced at $39.24, from $53.11 in 2015. Similarly, the price of books from a competitor brand, VitalSource, fell from $56.36 in 2016 to $38.65 in 2018. Thus, the ebooks have now dipped below the ‘affordable’ (as categorised by VitalSource’s vice president of education for North America) $40 mark which the industry has been working towards for a while now.

Apart from the allure of price, RedShelf’s powerful e-commerce engine makes it easy for students to locate e-books and other digital course materials, via its website. It also has a proprietary browser-based e-reader, which allows students to consume e-content and even make notes and highlight important text.

The startup also has a B2B product called RedShelf Bookstore, which is a customizable campus service for in-store and e-commerce transactions. Not to forget its independent tool, called RedShelf Adopt, which streamlines the adoption process between bookstores and educators.

RedShelf Inclusive makes textbooks more accessible

A survey released in 2014 noted that 65% of students prefer not to buy a textbook because of price even with digital content firms bringing down costs. These youngsters also believed that not having the correct study material would lead to lower grades. To remedy this issue, from being just a transactions-based company, RedShelf also adopted the subscription model.

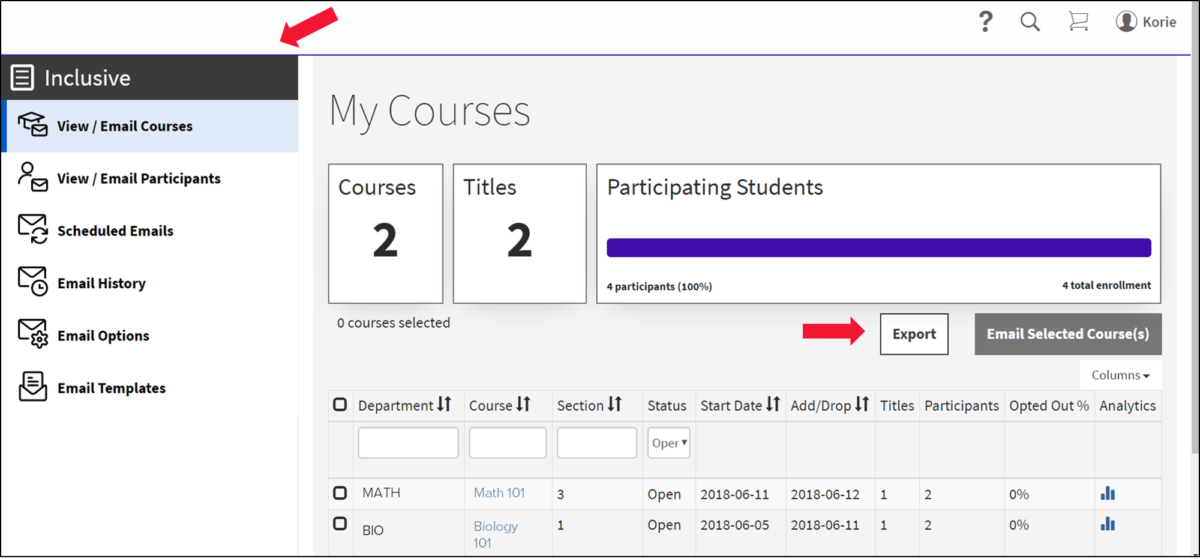

What students, of universities that tie up with RedShelf Inclusive, get is complete access to discounted eTextbooks, eBooks, course packs, OER, and publisher access codes that are integrated into learning management systems.

The hook is that the cost of this program is included in the student’s course fee, encouraging its adoption. Owing to this product strategy, RedShelf’s numbers show that only less than 6% of students opt out of the model. This means that teachers don’t need to worry about students having access to study materials from the very first day of class. Also, Redshelf believes that it could potentially lead to improved student learning outcomes. Research, conducted at one of RedShelf’s partner institutions, shows a 9% rise in students with grade “C” or higher (in the fall 2017 semester), as compared to a time when the program was yet not implemented. It also led to students of one of the partner institutions saving more than $330K in one semester, thanks to volume discounts.

The program also offers an analytics dashboard that gives teachers and campus administrators a window into what their students are actually reading. Such real-time ebook usage analytics also gives publishers insight into what improvements can be made to the books based on how often students are viewing content, where they are making annotations and so on.

The success of this inclusive model reflects in the 600% Y-o-Y unit growth the program has been experiencing. RedShelf Inclusive works with around 540 campus bookstores (to keep the content pipeline flowing) and more than 140 participating institutions. In fact, over two-thirds of the startup’s sales come from the inclusive access program.

Slow and steady wins the edtech-race

‘When we founded RedShelf, the higher education industry was still slow and hesitant to adapt to digital. We learned that to be successful, we couldn’t disrupt the industry — we had to work alongside it to improve the space. Since then, we’ve worked closely with our partners to accelerate the transition from print to digital,’ added Fenton.

It first saw an influx of capital in December 2013, with the $1M in seed funding from angel investors. This was followed by series A round in January 2015 ($2M) and series B in August 2016 ($5M).

The firm used the funds to expand its team size so significantly that by 2018 it had outgrown its previous three offices and occupied a new, 16,000+ square foot office. In a recent press release, RedShelf claims to offer 500,000+ digital titles across 400+ publishers and has partnered with 600+ campus bookstores. Over and above the 100+ employees currently on its Redshelf expects to hire 20 to 40 new employees within the next year and a half.

Then in August 2108, RedShelf ranked No. 121 on the Inc. 500 list of USA’s fast-growing private companies. “The depth of our development teams will be vital to our product expansion,” said Fenton to builtinchicago.

Investors are upbeat about edtech, as investments hit a historical new record of $9.5Bn in 2017. Since 2014, the US edtech market has achieved a CAGR of 8.81% and is expected to touch US$43Bn by 2019, to accommodate more players. Of the textbook segment, Amazon has a ginormous 23% share and is working with various universities (Purdue, US Davis) to provide high schoolers with affordable digital content. Flatworld (e-books start at $29.95) and Chegg (save up to 90% on ebooks), Cengage ($119.99 for a semester’s e-subscription), McGraw-Hill (saves up to 70% on ebooks) also offer digital solutions just like Vital Source and RedShelf.

“I can’t say for certain where we’ll be in five years, but our success will depend on our ability to continue producing innovative products, strengthening our partnerships and scaling the company in a way that stays true to our core values,” said Fenton to builtinchicago.

Subscribe to our newsletter