For those living in natural disaster-prone areas, home insurance is but a necessity. This is why, in October 2018, the Chicago-based insurtech startup Kin Insurance decided to extend its reach to Georgia (beyond its Florida operations). The AI-powered insurance firm makes it possible for residents of this state, regularly plagued by havoc-causing storms and floods, to secure tailored insurance quotes with just a few clicks.

“As a coastal state, Georgia is vulnerable to dangerous weather (including flooding, thunderstorms and hurricanes) and our mission is to help homeowners in high-risk areas of the US” Lucas Ward, Kin insurance’s CTO, said to Atlanta Business Chronicle. “Paired with Atlanta’s growing metropolitan area, expanding to help homeowners in this region aligns with our overall growth strategy.”

Ward also claimed that Kin Insurance will be “operating in a digital capacity” in Georgia, not taking office space or hiring employees in the state. The only other state that Kin Insurance services is Florida, but the startup plans to make its coverage available nationally by 2019.

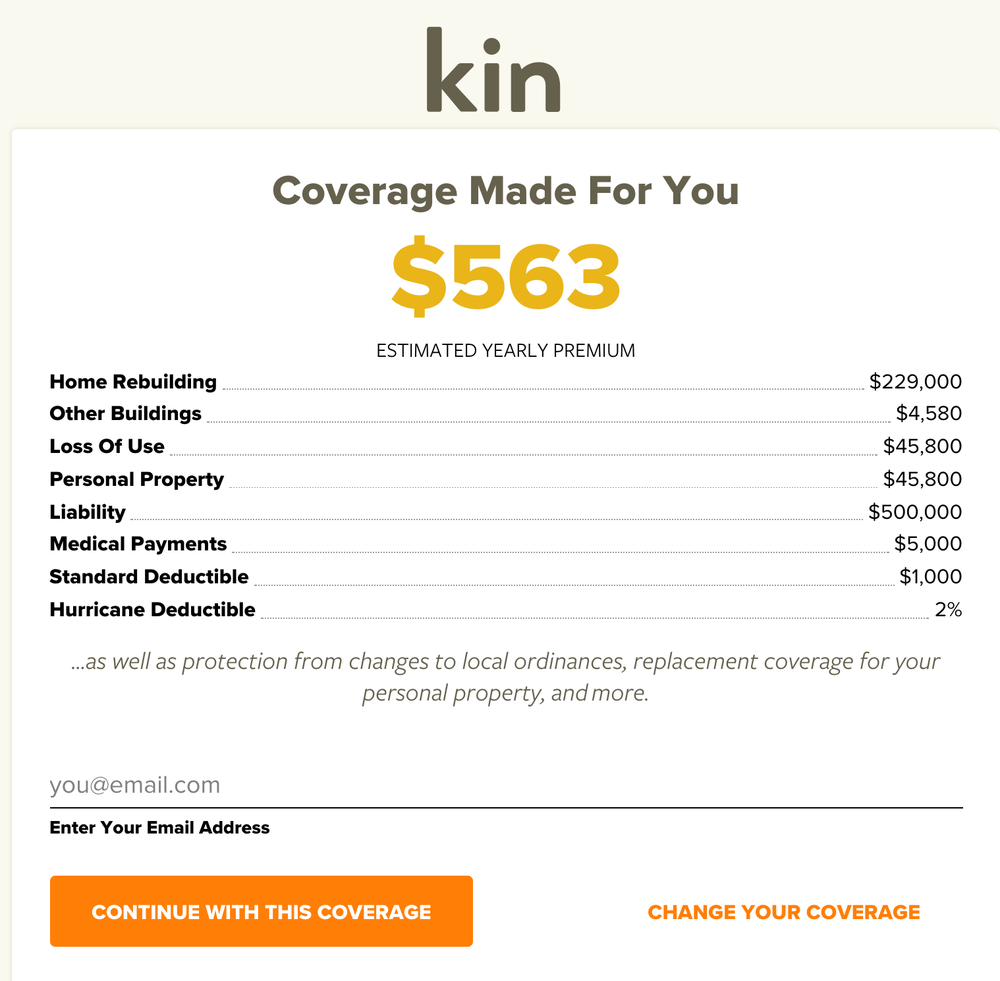

Kin Insurance provides specific packages tailored to fit hurricane susceptible homes. The Hurricane Florida package has a default deductible of 2% (which can be revised) and covers all wind-related damages and its deductible varies between $500 and 10,000+. They also offer advanced tech-based customer support for victims of natural calamities.

AI Smartens Insurance Purchase

Most traditional home insurance underwriters prescribe plans that do not take into consideration important factors such as the unique nature of the neighborhood or build of the home or even the specific needs of the homeowners. But the AI-powered Kin Insurance, through an underwriting partner, offers bespoke home insurance products rather than just reselling one-size-fits-all products from existing brands.

“It’s irresponsible for insurance companies to price coverage without using every bit of available data, but most simply lump homeowners together by ZIP Code,” Kin Insurance’s CEO Sean Harper said in an official statement. “We can save people substantial time, money, and confusion while getting them accurately priced coverage that fits their specific needs.”

What’s more, 94% of homeowners still issue their insurance policies by filling impossibly long insurance applications. These are filled with hundreds of inane questions (‘what per cent of your home’s foundation is poured concrete, concrete block, or pier?’) that homeowners don’t usually have accurate answers to. Kin Insurance makes redundant such archaic practices with disruptive technologies.

Kin Insurance programmatically gathers 5000+ address-specific data about people and their homes, from hundreds of reliable data sources, such as real estate listings and building records, as well as satellite and drone photography. Then big data analysis, AI and machine learning come into play to enable better risk assessment of the customer and therefore provide coverage recommendations.

All insurance applicant need to do is feed in their address on Kin’s website to instantly receive a tailor-made quote. This quote will be based on a variety of factors such as the age, condition, and construction of your home, location of home and individual’s insurance-based credit score. Then the features of the policy can be customized by choosing the limits and deductibles that fit the individual budget.

Kin Insurance also works with partners who can make homes safer so that applicants can qualify for even more insurance discounts.

By efficiently interpreting all this data, Harper believes that Kin Insurance is also able to make better marketing (especially social media and content marketing), underwriting and pricing decisions.

“It’s really important to have a model that handles all three of those, and it’s not something that legacy insurance carriers do,” he said to builtinchicago. “That leads to a lot of waste. For example, it’s very common for a legacy insurance company to send marketing materials to a customer even if they know they aren’t price competitive for that customer — or even if they know that they aren’t going to underwrite that customer.”

Since Kin Insurance’s business model is completely digital, by doing away with storefronts it helps save on costs. It also cuts out the 15-20% of commissions typically paid to an insurance agent. Then there are administrative costs, executive bonuses and lobbying efforts are considerably lowered. It also helps that Kin Insurance has its own proprietary software and thus not have to pay licensing fees to third parties for the same, though it will likely have to account for technology maintenance, upgrade and server costs. All this amounts to low company overhead, and these saving are passed on to insurance applicants in the form of lower premiums (depending on deductibles) for coverage of greater risk.

Ready to Disrupt the Insurance Market

Kin Insurance was launched in April 2017 by fintech veterans Sean Harper, Lucas Ward and Sebastian Villarreal, following an angel round of $650K in September 2016.

It was the increasing affordability of advanced data analytics and computing power, gave Kin Insurance’s founders the confidence to create computer models to battle with the insurance giants.

Then in August 2017, it raised $4M and also launched in its first state – Florida. In March 2018, they raised another $13M, backed by the Silicon Valley venture capital firm August Capital. This latest influx of funds is being used to help the company launch new products. At the same time, it was announced that the company has grown from 20 (in December 2017) to 60 employees.

Kin Insurance Expansion Drive

In conversation with WGN radio, Harper even mentioned that traditional insurance companies can’t seem to effectively target customers because they are built on old tech.

“Insurance is really far behind other areas of financial services, in terms of technological sophistication,” said Harper to builtinchicago. “In lending, Capital One can send you a mailer with a $50,000 credit line that you can click and be underwritten in seconds. Square can send you a dongle that you plug into an iPhone, and you’re able to process financial transactions in seconds.”

But he believes that Kin Insurance’s technology was built from scratch and will pave the way for legacy companies to move towards a more digitally advanced future.

CB Insights revealed that in 2016, US$1.7Bn investments were made into the global InsurTech market – double the volume and value of deals since 2014. So, investors are definitely ready to ride this fintech bandwagon the world over.

Specifically, for the US homeowners insurance industry, which has yearly revenues of around $100Bn, there is great potential for tech conversion. And even though its the pioneering market for insurtech, only 46% of these companies are headquartered in the US. Harper’s goal is to capture a substantial share of that market.“I haven’t seen an opportunity this big before, where you have an intersection of really complacent competitors and a huge industry that’s super-profitable,” he said to builtinchicago. “All of the fintech patterns apply to insurance, but even more so.”

In its efforts to grow, by August 2018, Kin Insurance had 10,000 customers from the 200 count in August 2017 (when it raised seed capital). Harper told the WGN radio presenter that a year ago, the question was whether the product will gain traction in the market but now it’s about optimizing the business model and scaling it for better growth.

Thanks to its big data advantage, Kin Insurance plans to focus its expansion to coastal states that have the greatest risk of being struck by storms and hurricanes. By applying data and risk models, it is able to differentiate itself from insurance bigwigs such as Allstate, State Farm and Liberty Mutual. But that is a lot of risk for even a low overhead company like Kin Insurance to undertake.

Luckily, cash-flushed reinsurance companies are willing to directly meet the financial underwriting risk for Kin Insurance, as Harper states. This means that property tech startups such as Kin Insurance don’t have to worry too much about raising big money.

Other AI-powered homeowners insurance firms such as Lemonade (offers insurance in 90 secs, saving 80%) Hippo (saves 25% on insurance bills and offers insurance in 60 secs) are also in this race to become the top property insurance player. Of the lot, Kin Insurance is the only one that is focused on regions that are commonly on high-alert for hurricanes.

Eventually, Kin Insurance expects to offer greater value to the customer by creating an end-to-end ecosystem for homeowners to safeguard their property. This also set it apart from the competition. In conversation with Chicago Business, Harper said that he expects Kin Insurance to eventually ‘worm their way into the rest of the home-owning experience’. “What we want is, five years from now, you buy a house, and a friend says, ‘You should get Kin with that.’ ” he added.

Subscribe to our newsletter