Everyone wants to know what Jim Rogers or Peter Brandt or Mark Cuban is thinking. Real Vision provides its subscribers access to full length interviews with financial moguls, giving them access to trade ideas and financial insights that were hidden until now. After a series A round in 2016 in which they raised $5 million, Real Vision recently raised $10 million in series B funding from hedge fund managers and investors to expand their operations.

The Real Vision Begins

The idea behind Real Vision started off when the founders met in Spain in 2012. They were unhappy with the way financial news was being reported. While thinking of alternative ways of delivering unbiased financial content, the idea of creating a highly focused on-demand channel occurred to them. One of the major driving force has been their strong conviction that the mainstream media and banks failed investors in 2008. Content such as one-sided stories, 3-minute videos, stock tips without the frameworks behind the idea, and the treatment of financial news as entertainment didn’t go down too well with them. They felt the mainstream media was treating investor savings flippantly by covering financial news as entertainment, the same way as sports news is covered.

The Founders (Left to Right) – Raoul Pal, Grant Williams, Damian Horner, Remi Tetot and Milton – The Puppet Master

The Founders (Left to Right) – Raoul Pal, Grant Williams, Damian Horner, Remi Tetot and Milton – The Puppet Master

The founders embarked on a mission for “truth in finance” which has evolved into “democratize quality financial research” over time. By 2013 they began working on their platform and launched in 2014. While their first launch ran into some technical troubles, they got it right the second time around. It is interesting that Real Vision already had over 1000 subscribers before they launched. Today, they have subscribers from over 100 countries.

Real Vision has four founders, all of whom are highly accomplished in their own fields.

Raoul Pal is an industry veteran. After working at Goldman Sachs, he a ran a macro hedge fund for GLG Partners before moving to Spain and starting an independent macro research called the Global Macro Investor. Grant Williams is also a finance industry veteran with over 30 years of experience at giants such as UBS and Credit Suisse across the globe. Damian Horner brings his experience in marketing and media and is the Chief Creative Officer. He featured in Campaign magazine’s ‘The 100 Most Influential People in Media’. Remi Tetot is the research head of Global Macro Investor and the CTO of Real Vision.

“Just Like Netflix”

Real Vision is an on-demand financial TV channel, “just like Netflix” they say.

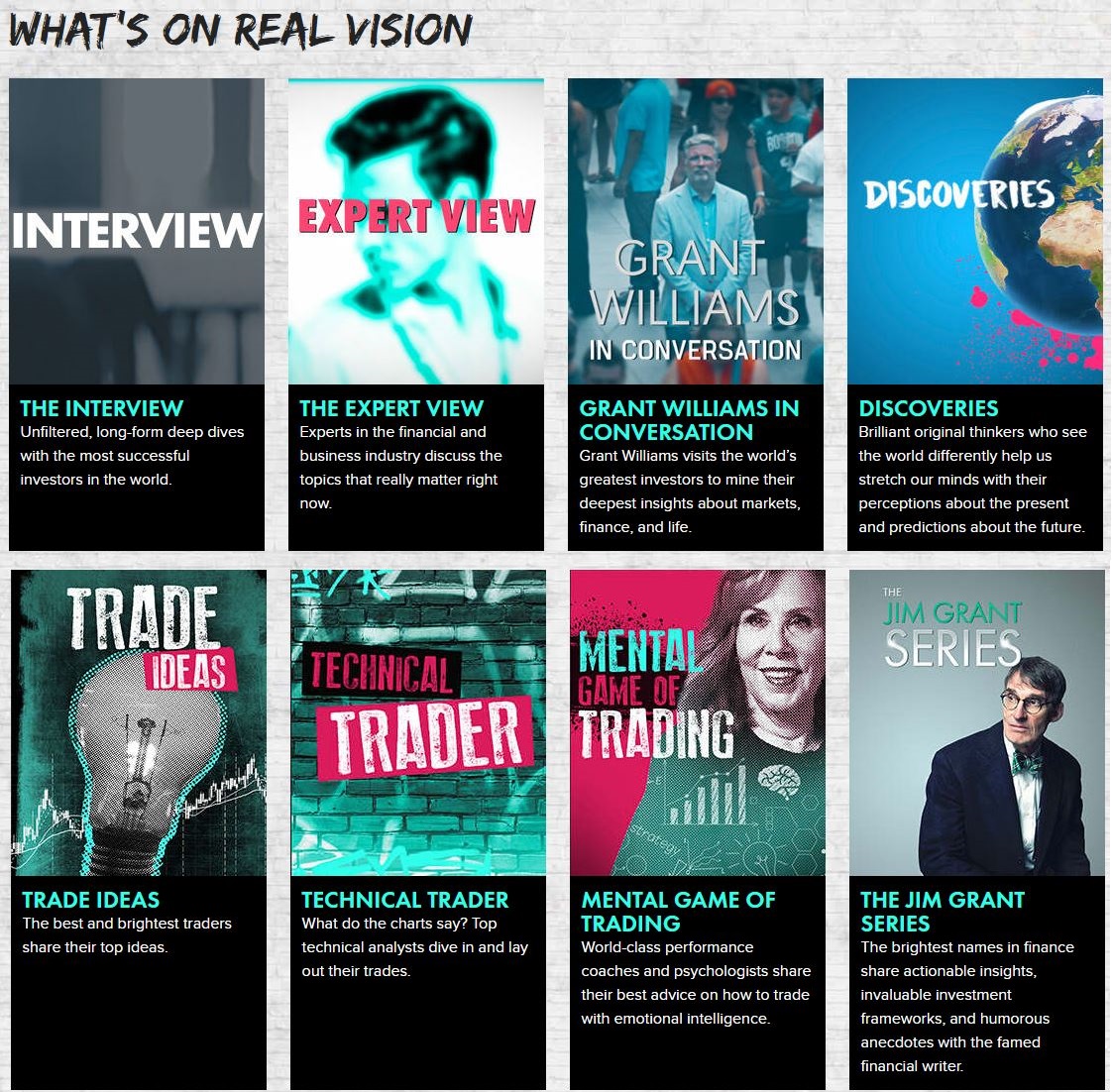

With video becoming the most popular medium of content delivery, video content is their core product. Their video offerings include full length interviews, documentaries, trade ideas (not tips!) among other things. Interviews with otherwise inaccessible investors and experts discussing a variety of issues from successes, failures, ideas, and trends, gives viewers unparalleled insight. Experts who are constrained by time on mainstream television networks can speak for an hour on the topic, allowing them to fully convey their ideas.

Raoul Pal (left) interviews Russell Clark of Horseman Capital

Videos are created in an accessible way to cater to audience with diverse backgrounds. Their content covers the fundamentals, technicals, and nuances, while also providing the big picture connecting the past and future. This allows them to present a holistic view giving different sides of the argument or story.

Rather than giving stock tips, they provide trade ideas where they show the underlying principles and ideas guiding the investment decision. This helps viewers develop their own analysis frameworks and grow as investors.

While video is their core product, they have a range of audio products and research content. Their products are a blend of original content and curation of the best available content. With investors being burgeoned with information, curation is key to ensure that investors get the best and most relevant information. Their newsletters, research reports and other such research materials are based on curation while their video content is developed in-house.

Real Vision TV product offerings

Real Vision has its “skin in the game” as its revenue model is based on subscriptions. This ensures all incentive structures are in alignment. Each of the products are priced differently. Real Vision Television is available to subscribers at $180 a year with discounted rates for students and CFA candidates. Real Vision Think Tank, the newsletter service, is available at $365 per year. Real Vision Macro Insider, their premium newsletter service, is priced at $2997 per year. With their focus on empowering people and democratizing finance, they have a weekly newsletter called ‘20/20’ and podcast (adventures in finance, now Knock-on Effect) available for free.

Real Vision is clear about their target audience and is focused on delivering content that adds value to them. Their subscribers range from students and educational institutions such as MIT and Cambridge to investor and financial institutions. They have strategically positioned themselves, striking a balance between curating and creating content. With the television and publishing businesses facing challenges, their medium and products are likely to succeed as they meet evolving consumer requirements. Recognizing this potential, a financial media firm offered to buy a 25% stake in Real Vision.

Raoul Pal (left) in conversation with Hugh Hendry

While it may be challenging for financial media outlets to create such a platform, it is not impossible as they already have all three mediums. However, each space is dominated by a different player. For example, the newsletter business is dominated by Agora, television and video space by Bloomberg, CNBC, etc. Companies such as Bloomberg and Thomson Reuters have an edge with access to investors given their additional product/service offerings. Real Vision recognizes that it cannot escape the strong position that incumbents have. They have partnered with Thomson Reuters to distribute their content to institutions. There is also a difference in focus between news and analysis.

One of the biggest challenges Real Vision faces is that of scaling up. As they broaden and deepen their content, they will have to experiment. Not all experiments will be well-received. For example, their switch from Adventures in Finance to Knock-on Effect was met with some negative response. As it gets difficult for the founders to keep driving all content, the shift to other accomplished professionals driving content may affect customer experience.

Mervyn King (left) Former Bank of England Governor in conversation with Jim Grant (right)

All that said, Real Vision definitely shows promise and is creating great content. They have a wide product offering for diverse customer types. While the success of the venture depends on subscriptions, they have already succeeded in creating high quality content.

Subscribe to our newsletter