Agriculture is perhaps one of the riskiest businesses in the world. Apart from overcoming challenges thrown up by nature, there are inherent inefficiencies and risks in the business model such as price fluctuations, cash flow mismatches and finding business partners. ProducePay, a Los Angeles based AgTech startup, has developed platforms and services that help provide financial solutions to farmers and distributors dealing with perishables such as fruits and vegetables while also creating a marketplace allowing them to transact online.

Farming Woes

Cash flow mismatch is a pain point for farmers across the world as their revenues come in after harvest seasons, which typically last for 2-3 months in a year, while expenses are met on a daily or weekly basis. These pressures exacerbate during harvest season when costs increase as farmers take on more workers to meet seasonal requirements.

Distributors typically operate on a consignment basis where they sell the produce on behalf of the farmer for a commission in order to avoid taking on risks arising from the perishable nature of the product.

As consignments cannot be used to raise loans and banks are hesitant to take perishable commodities as collateral, business practices act as an impediment for farmers looking to raise financing from banks. Industry forces have created an atmosphere where it is common for distributors to finance farmers in order to ensure continued relation and of-set the pressures arising from the lack of finances. Such practices put pressure on the finances of the distributor. On the one hand, capital is stuck in the form of advances while on the other hand, the amount of business they do is constrained by their capacity to issue advances and not just their marketing and sales capabilities.

The critical problem emerges from cash flows acting as constraints in the business. Pablo Borquez Schwarzbeck, founder of ProducePay, recognized the need farmers and distributors of fresh produce have to access funds from a reliable source, as quickly as possible, when required.

Pablo Borquez Schwarzbeck, Founder and CEO, ProducePay

Pablo Borquez Schwarzbeck – The Founder

Coming from a 4th generation farming family in Mexico, Pablo was exposed to the challenges of farming from his childhood. After graduating from college, Pablo went on to work for The Giumarra Companies, a leading produce marketing company, and subsequently Campos Borquez, the Borquez family farm that is a leading producer and supplier of asparagus and grapes in North America.

During his time at the Giumarra Companies, Pablo managed grower relations in the US and South American countries such as Argentina, Chile, and Uruguay. Through this, he understood the magnitude of the cash flow and partnership problem. It was in 2014 while Pablo was at Cornell University pursuing his MBA that he came up with the idea of creating a platform to solve these challenges and founded ProducePay.

The ProducePay Platforms

ProducePay has two complementary platforms – the financing platform and the trading platform.

The financial platform focuses on providing financial assistance of up to 80% of the crop value. Rather than issuing loans, ProducePay purchases these products at a discount by way of advancing a certain amount and obtaining a ‘flash title’. When the revenue from sales is realized, ProducePay recovers the amount initially advanced,takes an additional 1% commission of the entire proceeds, and returns the balance amount to the farmer. The producer and distributor are on-boarded on to their platform and can track the entire transaction in order to ensure transparency. This model helps them circumvent the country/state specific lending norms and scale across the globe.

Based on the stage of the order, a percentage of the value of the crop is advanced – up to 10% of the value during pre-season, up to 50% at the pick & pack stage, and up to 80% at the invoice stage based on confirmation of delivery. This helps ProducePay mitigate risk arising from price fluctuations and spoilage.

It is important to recognize that ProducePay only funds accepted orders, where the distributor has accepted the consignment, as it signals the ability to realize the monetary value of the produce. Since there are numerous consignments being sent, they are able to cross-collateralize shipments and recover their money in case of a rejection.

ProducePay allows farmers easier access to liquid capital

ProducePay has essentially enabled farmers and distributors collateralize their produce and raise money at different stages to meet their working capital requirement and improve cash flows. Farmers are able raise money to meet their expenses.

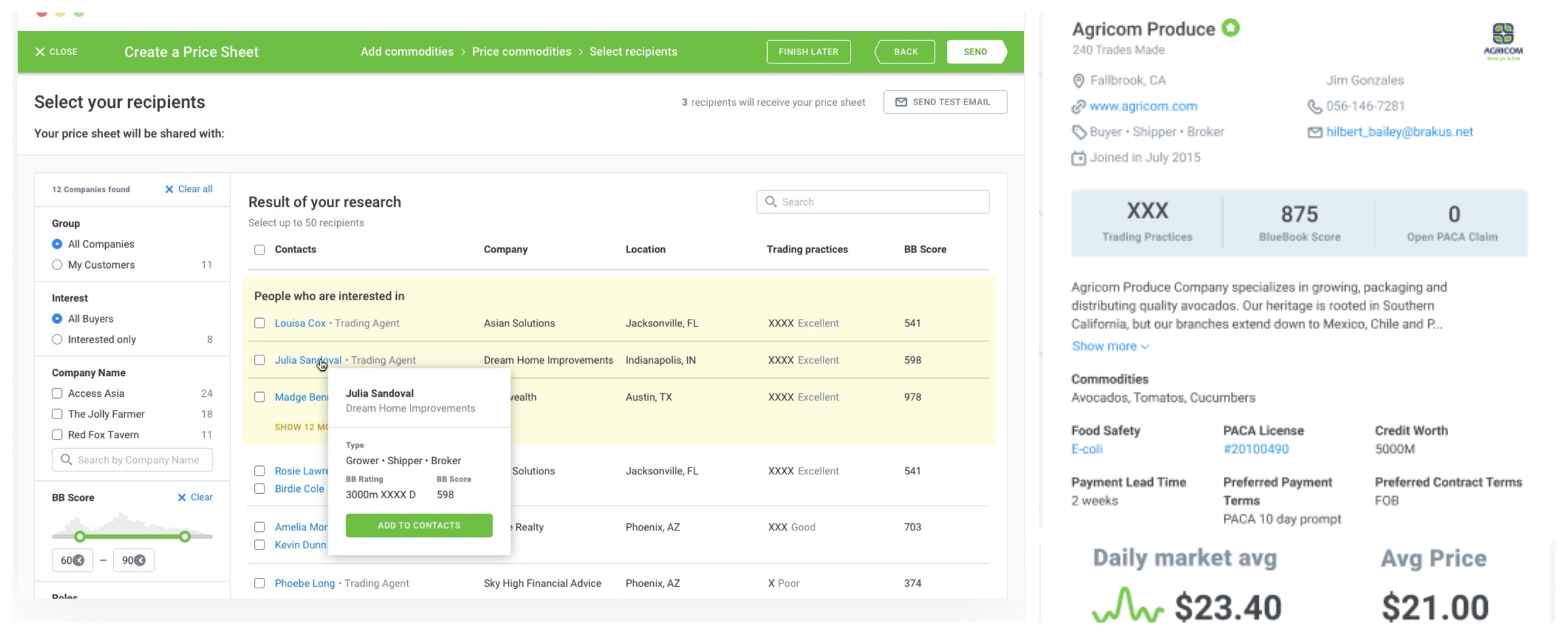

Following the success of the financing platform, ProducePay evolved a transaction platform as a natural extension, enabling distributors and producers to find each other and partner. As ProducePay vets both sides while onboarding them onto their platform, there is an element of trust in these interactions. ProducePay has also partnered with Blue Book Services, a credit rating and market intelligence provider for the produce industry, in order to provide buyers and sellers with additional information to inform their trade decisions.

Data analytics forms a key component in supporting both platforms. ProducePay is able to combine historic and prevailing market price data with data generated on the platforms and translate it into guidance valuations on the finance platform and guidance prices on the transaction platform. This helps producers, distributors and ProducePay make informed decisions.

The platforms have been designed keeping in mind the various literacy levels, language barriers, and technological comforts levels in order to make it universally accessible.

ProducePay Trading Platform (PC: ProducePay)

The Market

Of the $81.4Bn worth of ‘plant food’ that was imported in 2017, nearly $31Bn of it is fruits and vegetables. With more than half of the fresh fruit and almost a third of the fresh vegetables bought in America being imported, ProducePay has been able to expand internationally leveraging on the US market. Apart from the US, ProducePay services clients in Mexico, Canada, Honduras and Chile, countries that are among the top 10 import partners.

While there has been international expansion, ProducePay is solely focused on the US market as the final sale market, thereby limiting their country risk. ProducePay engages with distributors in the US and reaches out to their suppliers (producers – US and abroad), working backward through the supply chain. It is otherwise difficult to reach out to farmers given their geographical fragmentation.

The AgTech Landscape

ProducePay is growing exponentially: from financing $17M in their first year of business (2015) to over $400 M in 2017. Since its founding, the company has financed 600+ farmers and distributors to the tune of $850M. Their platform has on average 1500+ loads traded per day.

After raising $10.9M over two seed rounds and a series A round spread across 2015-17, ProducePay recently raised $14M in series B funding. The round was led by Anterra Capital, with participation from Rabobank’s Rabo Frontier Ventures, Coventure, Moonshots Capital and Social Leverage among others. The company’s ability to raise funds at a time when investments in AgTech are rebounding predominantly due to growing early stage investments, signals increased strength and confidence in ProducePay. Funds from the series B raise will be deployed to scale the business further while also developing the software platforms.

The advantage ProducePay has when compared to traditional banks is its ability to fit into the transaction process recognizing the consignment nature of transactions. Banks require a stronger documentation base while reviewing a loans application. With more competitive charges and an array of additional services such as a trading platform and access to the US market, ProducePay has a higher value proposition when compared to local banks which are solely focused on collateral driven interest based loans.

Team ProducePay (PC: ProducePay Facebook)

While ProducePay faces little direct competition, platforms such as Farmers Business Network are expanding their product offerings which marginally overlap with ProducePay while the models are different. The end focus in on creating a ‘one-stop’ marketplace for all the farmers needs. Including the $70M in debt financing raised last year, ProducePay has raised $95M since its founding and is on the path to becoming a FinTech leader in the AgTech space. ProducePay has been recognized multiple time by Forbes and others such as Tech Tribune as one of the most innovative AgTech startups.

Subscribe to our newsletter