Blueprint Income has raised a $2.75 million seed investment led by Green Visor Capital to help Americans retire with a guaranteed income.

While no one can be certain how much that guaranteed income should be, the answer to that question is very crucial while planning for retirement. However, unpredictable medical expenses and the (mis)fortune of longevity, i.e. the danger of exhausting your resources while you’re alive, can upset the most robust financial plans.

According to a recent survey, a lot of baby boomers – born between 1946 and 1964 – can’t retire even if they want to. The 2018 Retirement Savings survey found that 42 percent Americans have less than $10,000 saved – an amount not enough to cover even a year’s expenditure. Undoubtedly, the topic of retirement and living comfortably once the paychecks stop coming in can cause many to break a sweat.

Naturally, the first and most crucial step is to save. But along with rigorous saving, it is important to invest in a smart retirement plan that will save you from market volatility, and ensure that nothing disturbs your retirement funds.

Blueprint Income with its good old annuity plans can help.

An annuity is a financial contract with an insurance company that provides guaranteed payments for a specific period of time, typically beginning when you retire. But they’ve not been a particular favourite with retirees. In 2015, annuities totalled at $11.8 billion, to $7.3 trillion held in I.R.A.s according to Limra, an insurance industry research group.

This is because annuities can be complicated and involve a one-time high premium: say if a couple paid $300,000 on a single-premium annuity, they could get about $13,000 annually once they retire. And, according to Matthew R. Carey, the CEO of Blueprint income, this high cost of the premium has long been a barrier.

CEO Matthew R. Carey (PC: BluePrint Income)

Carey was advising the Treasury Secretary on the future of retirement when he came up with the idea for Blueprint Income. He knew that market risks and increasing longevity was exposing many Americans to a situation where they could run out of money in their later years. He wanted to do something about it. Carey left the Treasury Department to pursue an MBA at The Wharton School where he met his co-founders, Nimish Shukla and Adam Colombo.

He left the Wharton programme to launch Blueprint Income in 2014, and made sure that the upfront premium is as low as possible: It’s currently at $5000 and they’re working on reducing it even further.

Personal Pension

The company aims to reinvent the retirement, especially the annuity market – which like the restaurant industry we, at Techweek, previously discussed – is not particularly enthusiastic about technology. Insurance companies assume, especially with older individuals planning for their retirement, that people prefer hand-holding over a detailed, responsive digital interaction. This strategy also helps the companies get away with less-informed agents and a bombardment of sales calls. Their dissatisfied clients consistently accuse them of being pushy, non-transparent, and unperturbed with the client’s benefit.

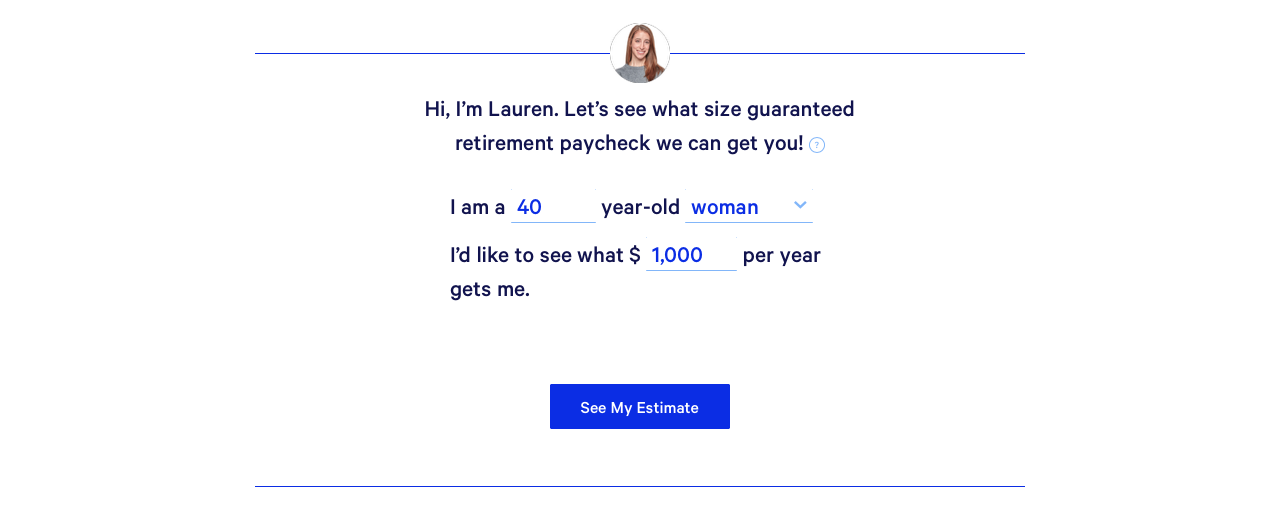

Blueprint Income, on the other hand, has tried to fill this gap in the market, keeping all these grievances in mind. First, it claims it is a fiduciary – a person who holds a legal or ethical relationship of trust with you. Second, it has invested in a responsive website with features like a real-time annuity calculator.

It also doubles up as a resource centre for all your retirement questions. And finally, it boasts an enviable customer service where the founders themselves are available to talk to you and advice you on your pension plans. They don’t charge you for the advice but are paid a commission by the insurer you buy from.

Guaranteed Monthly Income

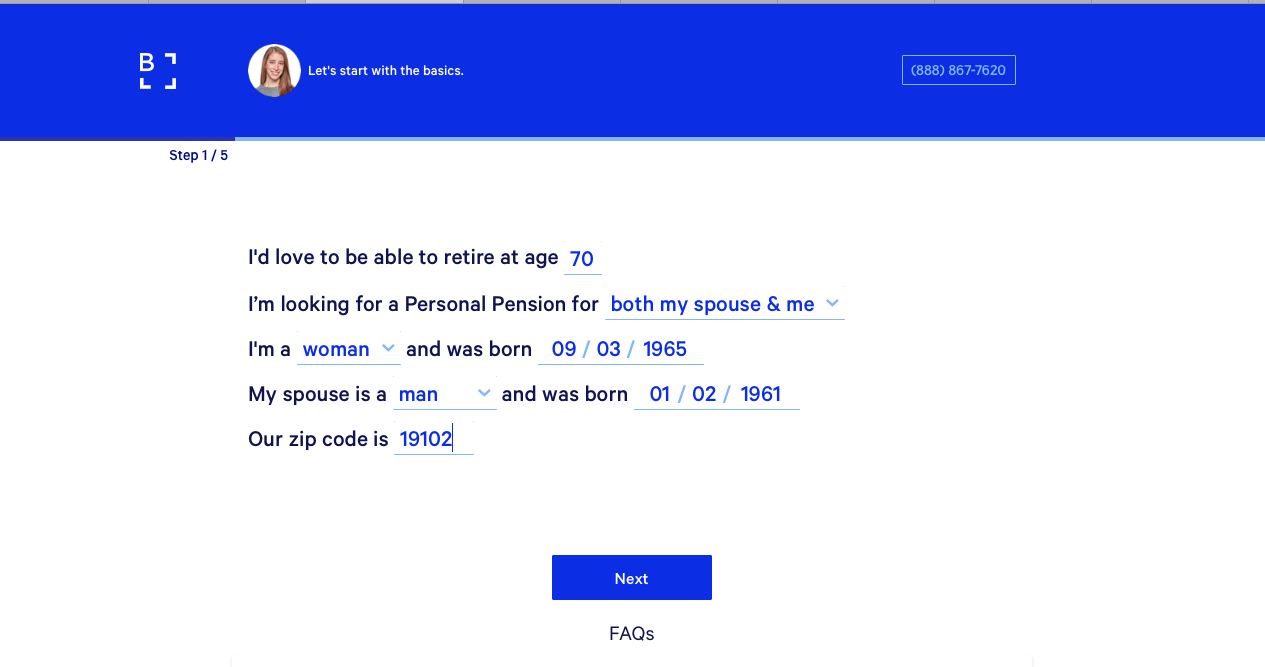

Blueprint Income operates on a deferred-income annuity model where you can pay your premiums monthly till you retire. How much you receive monthly once you retire is based on how much you have contributed. Therefore, Blueprint Income suggests that you must delay your retirement age as much as possible to receive a higher monthly income.

It builds a personal pension plan for people under its premise of offering a consistent stream of income through annuities. Only it’s not an insurance company but a platform that hosts the top companies and does the dirty work of finding the best quote for you.

A cursory scroll through Blueprint Income’s reviews shows that it’s the website’s income calculator and immediate quotes that users love the most. After receiving your details such as at what age you would like to retire and your monthly income goal, Blueprint Income gets to work to build your personal pension profile.

Say you’re a 50-year-old woman who is going to retire at 70 and has a monthly income goal of $3000 a month. Blueprint Income can immediately reveal that to receive $3000 per month after retirement for the rest of your life, you can start with a premium as low as $100 but increase it 25% annually. Or you can pay a higher premium of $563 per month, increasing by 10% annually or $946 per month, increasing 5% annually.

There’s also an option to get real-time quotes. Once you fill in your details, the NY-based startup throws quotes from top companies like Lincoln Financial Group, New York Life, Mass Mutual Financial Group, among others. Apart from the price, you can compare these quotes on the basis of insurer credit ratings such as AM Best Rating, Fitch, Moody’s, etc. And what happens if you die before your income can begin? The FAQs answer many such questions and more: Your Personal Pension comes with the refund at death feature, where the money will be given to your beneficiaries.

Blueprint Income is hopeful that with personal pension, it can revolutionise the annuity market – bringing costs down, improving transaction speed, and making it easy for anyone to sign up – just like buying a stock. But it’s its role as a fiduciary soon kicks in as its Carey himself advises that an “annuity is not meant to replace your 401(k) or an IRA”, but supplement it for a diversified retirement plan.

Subscribe to our newsletter