We live in times where 25% of Americans claim to be taking four or more prescriptions – according to a poll conducted by the Kaiser Family Foundation. Yet, the costs are so high that sometimes people end up having to choose between paying their mortgage or buy life-saving drugs such as insulin. To eliminate this scourge of over-priced drug, online pharmacy Blink Health was conceptualized by co-founders and brothers, Matthew and Geoffrey Chaiken who come from a long lineage of doctors.

This ‘first e-commerce service of its kind’ enables American residents to buy low-cost generic prescription drugs, pay for it online, and then pick it up from nearby pharmacies. Since October 2018, Blink Heath has upped the convenience factor a few notches with the launch of its home delivery option.

Geoffrey Chaiken was quoted in a company announcement saying, “We’re adding home delivery because modern retail requires consumer choice and the integration of online, physical retail, and delivery.”

Owing to the time-sensitive and personal nature of most prescriptions, this multi-channel strategy may prove noteworthy.

“We started as the opposite of a lot of other people… We started with retail, in-person pickup, and then went online and home delivery,” he added in an interview with Fortune.

Set up in a Blink

Before embarking on the Blink Health journey, Geoffrey had also founded a speciality pharmaceutical company called Marinus Pharmaceuticals. Simultaneously, Matthew served as an investment professional (with a focus on tech and consumer products) at a New York-based investment firm.

In these pre-Blink roles, the duo noticed the persistently low levels of satisfaction amongst Americans (a sizeable portion of whom are not covered by health insurance) relating to the drug prices. This insight inspired the brothers they launch the free Blink Health app and website in February 2014, which claims to save 95% of the customer’s prescription price. The product’s stark markdown in pricing is especially suited to the low-income American and those who are not covered by health insurance.

All users need to do is ensure that their prescription has reached their local pharmacy and then flash their proof of purchase (Blink Card) to pick up their discounted meds from over 33,000 pharmacy partners (such as Walmart, Safeway and Kroger). Or users can opt for home delivery of the medication.

Supply Chain Hack for Discounted Meds

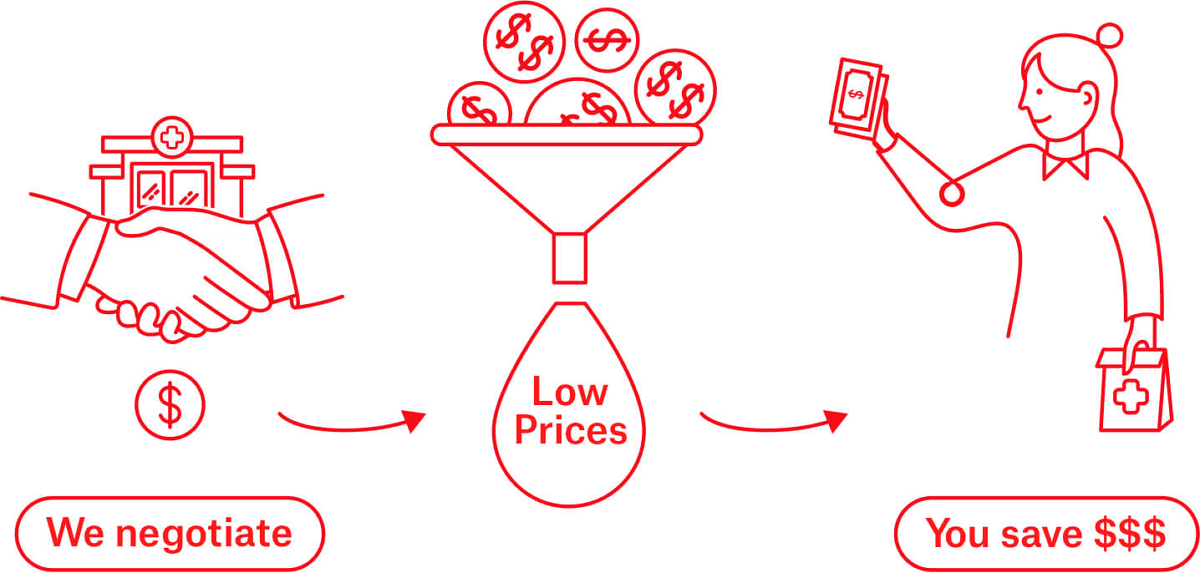

The New York-based online pharmacy negotiates directly with prescription medication suppliers (drug companies) and uses technology to cut-out the middlemen such as insurance companies and pharmacy benefit managers (PBM). The money saved is passed on to customers and Blink Health takes a cut of that purchase.

It even offers partner pharmacies an assured rate in exchange for lower prices for Blink Health customers. Through a crowdsourcing approach, Blink Health is able to negotiate best-in-market deals with drug companies.

“It’s primarily about power in numbers,” Geoffrey told CNBC. “So we’re able to group our Americans together with a whole host of others, about 25 million and that gives us the negotiating power to get much lower prices for all of our users.”

Blink has built a bank of repeat buyers who are also incentivized, with the promise of lower product prices for all, to refer others.

For better savings, users can even opt for the ‘Blink Smart Deal’ where they get to choose from 5,000 pharmacies that offer cheaper medicines. A common prescription drug, such as Lipitor, would cost $6.96 (with a smart deal applied) on Blink as opposed to its average retail price of $46.58 elsewhere. The only caveat being: the customer has to switch their prescription to that pharmacy.

At times, Blink Health also offer better rates than even the insurance companies, making that health vertical redundant.

For these reasons, online pharmacies such as Blink Health are said to have truly disrupted the retail pharmacy industry that has been mired in controversies and unhealthy competition for years now.

“Blink is really trying to bring e-commerce and transparency into this very closed industry of very powerful players,” said Bill O’Donnell, executive vice president of engineering at Blink Health, to Xcomony.

This is particularly relevant as, in the last few years, PMBs (such as Express Scripts) have been pulled up by the US administration for their alleged role in driving up drug prices. While PMBs are essentially supposed to negotiate discounts with drug makers on medications, the complaint is that most of the savings don’t seem to reach the end customer.

Lawsuits and the Inception of Blue Eagle

Around its launch, Blink Health had partnered with 60,000+ pharmacies. However, starting March 2017, many of the pharmacies withdrew from Blink’s network, including Walgreens and CVS pharmacies.

Owing to the exit of such high-profile pharmacy chains from its network, Blink Health called off its partnership with MedImpact, the PMB that was charged with helping the startup connect and manage its relationship with pharmacies. To bring back some stability to its business, in March 2018, Blink Health forged a partnership with industry executives to create a new PBM, called Blue Eagle.

“If we were going to create an alternative to the prescription management industrial complex, we needed to create a system that worked for pharmacies, worked for patients, and worked for manufacturers,” Geoffrey told Business Insider.

Blue Eagle manages a network of pharmacies where Blink’s discounts can be used. Blink Health’s PMB sister-concern offers pharmacies complete transparency into the costs of each drug purchased, without levying any unfair fees. Neither does it impose “gag orders”(a common practice amongst PMBs) on pharmacies to prevent them from alerting patients about lower medicine prices.

Additionally, Blink Health even filed a $250 million lawsuit, in March 2018, against competing brand Hippo for allegedly engaging in an “unlawful copycat scheme.” While this case is still sub-judice, it is one of the many lawsuits that Blink Health has been embroiled in over the past few years.

Online Pharmacy Industry

In June 2018, Amazon announced its plans to acquire convenience-based online pharmacy startup PillPack. Apart from the e-commerce giant, Blink Health has to deal with other competing online pharmacy brands such as RX Save (saves up to 94% on medicine rack rate), and Good Rx (saves up to 80% on medicine rack rate) that play the competitive pricing card to grow in scale. There is also RX Savings Solution, a membership-based service, that on an average helps users save $300 per year.

Blink Health plans to keep playing the low-price card

On the other hand, these online pharmacy brands are collectively causing offline retail pharmacies to lose out on their high-profit cash business. To stay relevant, large retail chains are offering home deliveries, consolidating and acquiring other health-care businesses as partners. Owing to this ongoing tussle for power, industry experts forecast a pharmacy shakeout in the next five years.

Blink Health plans to continue its crusade by playing the low-price card. “Our price match guarantee establishes Blink Health as the definitive place to get the lowest Rx prices, every day. We plan to create additional programs, expanding access to vital medications for all Americans,” said Matthew in a press note.

Yet, since over 50 per cent of the listed medications is priced at less than $10, Blink Health’s margins are pretty thin. In conversation with CNBC, Geoffery added, “..we make, depending on which drug you take and which pharmacy you go to, a little bit of money, we actually can lose money as well.”

As the online pharmacy market is predicted to reach around $128Bn by 2023, Blink Health is confident the solution to the profitability conundrum is to get as many members as they can. Through their Blink Health Nation program, they believe that cost advantage through economies of scale can be achieved by increasing member base.

Subscribe to our newsletter